Exploring the Advantages of an Equity Financing for Your Economic Objectives

As individuals navigate the elaborate landscape of monetary planning, discovering feasible choices to achieve their monetary purposes comes to be critical. Amidst the array of economic tools available, equity lendings stand out for their possible benefits in aiding people to reach their financial objectives. The advantages that equity lendings supply, varying from flexibility in fund use to prospective tax obligation benefits, offer an engaging instance for factor to consider. Nonetheless, there is a much deeper layer to this monetary instrument that warrants focus - a layer that could significantly impact one's monetary trajectory.

Versatility in Fund Use

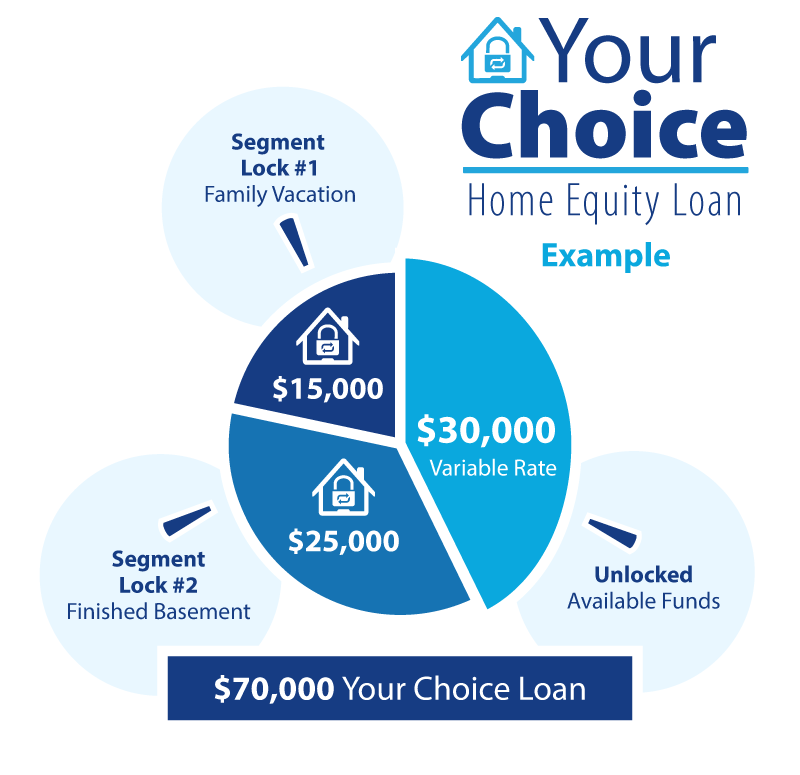

Flexibility in making use of funds is a vital benefit connected with equity lendings, offering consumers with versatile choices for managing their finances effectively. Equity finances permit individuals to access a line of debt based on the equity they have actually constructed up in their homes.

Additionally, the versatility in fund usage includes the amount borrowed, as consumers can commonly access a huge sum of cash relying on the equity they have in their home. This can be particularly advantageous for people aiming to fund substantial costs or projects without turning to high-interest choices. By leveraging the equity in their homes, borrowers can access the funds they require while taking advantage of potentially reduced rate of interest contrasted to various other types of borrowing.

Possibly Lower Interest Rates

When thinking about equity finances, one may discover that they provide the capacity for reduced rate of interest compared to different borrowing choices, making them an appealing economic choice for several people. This advantage comes from the truth that equity finances are protected by the consumer's home equity, which decreases the threat for lending institutions. Because of this decreased level of risk, lending institutions are typically prepared to supply lower rates of interest on equity lendings than on unprotected car loans, such as individual lendings or charge card.

Reduced rate of interest prices can result in substantial cost savings over the life of the car loan. By protecting a reduced rate of interest through an equity finance, customers can possibly minimize their general rate of interest expenditures and lower their regular monthly settlements. This can liberate funds for various other monetary goals or expenditures, inevitably improving the borrower's economic position over time.

Accessibility to Larger Funding Amounts

Offered the potential for lower rate of interest with equity lendings as a result of their secured nature, debtors may additionally profit from access to bigger lending quantities based on their available home equity. This accessibility to larger loan quantities can be useful for individuals aiming to fund significant monetary goals or projects (Equity Loan). Whether it's for home remodellings, financial obligation combination, education and learning expenses, or various other considerable financial investments, the capacity to borrow even more cash through an equity financing provides debtors with the financial flexibility required to attain their purposes

Potential Tax Benefits

Safeguarding an equity financing might offer prospective tax advantages for customers looking for to optimize their economic advantages. In numerous situations, the rate of interest on an equity funding can be tax-deductible, comparable to home loan interest, under certain conditions.

Additionally, utilizing an equity lending for home renovations may also have tax benefits. By utilizing the funds to refurbish or improve a second or key residence, house owners may increase the property's value. This can be helpful when it comes time to offer the home, possibly lowering funding gains tax obligations or also receiving certain exemption limits.

It is vital for debtors to seek advice from a tax expert to totally recognize the you can try this out details tax implications and advantages associated with equity fundings in their private situations. Alpine Credits.

Faster Approval Refine

Final Thought

In summary, an equity finance offers versatility in fund usage, potentially reduced rates of interest, access to larger car loan quantities, potential tax obligation advantages, and a faster authorization procedure. These advantages make equity lendings a sensible alternative for people aiming to accomplish their financial goals (Alpine Credits). It is vital to carefully take into consideration the conditions of an equity funding before making a decision to ensure it straightens with your details financial requirements and goals

Offered the potential for reduced interest rates with equity car loans due to their protected nature, borrowers might likewise benefit from accessibility to bigger loan quantities based on their offered home equity (Equity Loans). In comparison, equity lendings, leveraging the equity in your home, can use a quicker approval process since the equity offers as security, minimizing the danger for lenders. By choosing an equity finance, customers can expedite the financing approval process and gain access to the funds they require without delay, supplying a valuable economic solution during times of urgency